OYO Hotels & Homes in 2026: Technology, Trust, and the New Shape of Global Hospitality

A New Era of Travel and OYO's Place Within It

By 2026, global travel has moved well beyond the volatile recovery years that followed the pandemic, and the hospitality sector has entered a more mature, digitally enabled phase in which flexibility, trust, and value are the core currencies. Within this context, OYO Hotels & Homes stands as one of the most influential technology-led hospitality platforms, especially in the budget and mid-scale segments that matter most to price-conscious leisure travelers, small business road warriors, and families planning multi-stop itineraries.

For readers of World We Travel, who look for practical, global perspectives on destinations, business travel, family trips, and the evolving hotel landscape, OYO's journey from a single property in Gurgaon to a multi-country platform is an instructive case study in how technology, standardization, and data can reshape accommodation markets across the United States, Europe, Asia, and beyond.

As travel in 2026 becomes more hybrid-mixing work and leisure, digital nomadism and short city breaks, wellness retreats and eco-conscious escapes-OYO's model illustrates how a company can scale while still promising affordability and reliability, particularly in markets where traditional hotel chains have not fully addressed the needs of domestic and regional travelers.

From Gurgaon Startup to Global Network

When Ritesh Agarwal launched OYO in 2013, the company's founding premise addressed a very specific pain point in India: a fragmented budget hotel sector with wildly inconsistent standards, opaque pricing, and limited digital visibility. The early OYO model focused on identifying underperforming budget properties, standardizing rooms and services, and then applying a unified brand, centralized marketing, and technology-driven operations.

This approach resonated quickly with younger travelers in India, especially those booking last-minute city stays and short business trips. At a time when online travel agencies such as Booking Holdings' Booking.com and Priceline, and Expedia Group's portfolio were still heavily skewed toward branded chains and well-known independents, OYO's promise of standardized budget rooms booked instantly through a mobile app filled a gap in the domestic market. Travelers who might otherwise have relied on word of mouth or local agents could now access a curated, tech-enabled inventory of budget stays.

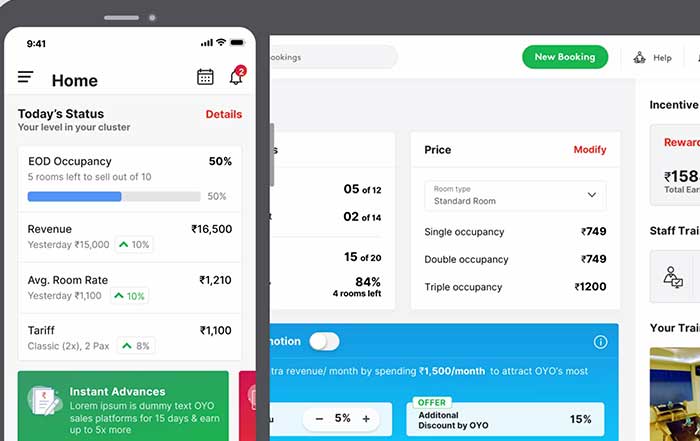

As the platform matured, OYO invested heavily in its full-stack technology infrastructure, building property management systems, dynamic pricing tools, and integrated booking engines. This allowed small hotel and guesthouse owners-often family-run businesses in secondary cities-to plug into a sophisticated digital ecosystem they could never have afforded independently. For many of these owners, joining the OYO network meant gaining visibility on global search platforms, benefiting from centralized revenue management, and accessing training and standard operating procedures that raised service levels.

Technology as the Core Infrastructure

By 2026, the hospitality industry is deeply intertwined with data, automation, and AI-driven decision-making. OYO's platform strategy anticipated this shift early, and the company's technology stack has become central to its business identity and to the experience it delivers to travelers.

OYO's property management and revenue optimization systems continuously analyze booking patterns, local events, competitor pricing, and historical data to recommend room rates and promotional strategies to partner properties. Similar to how leading analytics tools and travel intelligence providers operate, OYO's algorithms support owners in managing occupancy and yield, which is particularly critical in price-sensitive markets where even small changes in average daily rate can significantly impact profitability.

On the guest side, OYO's mobile app and web interfaces have evolved into more intuitive, AI-assisted platforms, offering personalized suggestions based on past stays, location preferences, and even patterns of business versus leisure travel. In markets where digital adoption is high, such as the United States, the United Kingdom, Germany, and Singapore, this kind of intelligent interface aligns with broader consumer expectations shaped by platforms like Airbnb, Uber, and major e-commerce marketplaces.

In parallel, the company's AI-powered chat and customer support tools have become an important part of the booking and stay experience. Travelers accustomed to real-time assistance now expect instant resolutions to reservation changes, refund queries, and special requests. The ability to support this at scale, across multiple languages and regulatory environments, differentiates technology-led hospitality platforms from traditional chains that still rely heavily on property-level call centers and manual processes. Those interested in the broader role of AI and automation in travel can explore industry analyses from organizations such as the World Travel & Tourism Council and the World Economic Forum.

Global Expansion, Local Adaptation

OYO's move beyond India into markets such as China, Southeast Asia, Europe, and North America was both ambitious and instructive. In each region-whether Spain and Italy, where independent hotels and family-run pensions dominate many leisure destinations, or the United States, where budget motels and roadside properties form a large but fragmented segment-the company applied its core playbook of standardization and tech enablement, while adapting to local regulations, consumer expectations, and competitive dynamics.

In Europe, for example, OYO had to navigate strict consumer protection laws, labor regulations, and a strong tradition of independent hospitality. In markets like the United Kingdom, Germany, and the Netherlands, the company's ability to offer a branded, tech-enabled alternative at the budget and lower mid-scale level made it particularly relevant to younger travelers and small-business road warriors seeking predictable stays without premium chain pricing. Readers planning multi-country itineraries across Europe and other regions increasingly encounter OYO-branded properties alongside traditional chains and local independents.

In Asia, including markets such as China, Thailand, Malaysia, and Singapore, OYO's growth strategy intersected with fast-rising domestic tourism, growing middle-class incomes, and the rapid adoption of mobile-first booking behavior. Partnerships with local owners and integration with regional payment platforms and super-app ecosystems helped OYO embed itself into everyday travel habits. Reports from organizations such as the UN World Tourism Organization and the OECD Tourism Committee have highlighted how such digital platforms are reshaping intra-regional travel flows across Asia and the broader Global South.

Competitive Positioning in a Crowded Market

By 2026, the accommodation market is more competitive than ever. Traditional hotel groups such as Marriott International, Accor, Hilton, and InterContinental Hotels Group, along with alternative accommodation platforms like Airbnb, Vrbo, and Booking.com, all compete for a share of leisure, family, and business travel. OYO's differentiation lies less in offering unique properties and more in providing a standardized, value-driven experience at scale, especially in the budget and lower mid-scale categories where many global brands have limited reach.

The company's focus on competitive pricing, enabled by technology-driven cost efficiencies and revenue optimization, remains central to its appeal. For budget-conscious travelers comparing options across multiple platforms, OYO's combination of price, basic amenities, and instant confirmation can be particularly compelling. Travelers researching options can cross-check regional pricing and demand trends through sources like Statista or the U.S. Travel Association for North American dynamics.

At the same time, OYO has diversified its portfolio to include more premium properties, vacation homes, and longer-stay formats, responding to the rise of blended travel in which guests may work remotely for part of their stay. This aligns with broader patterns that readers can explore in World We Travel's coverage of work and travel, where flexible accommodation and reliable connectivity are as important as location and price.

Impact on Small Owners and Local Economies

One of OYO's most significant contributions to the hospitality ecosystem has been its role in empowering small and independent property owners, particularly in emerging markets and secondary cities that receive fewer international chain investments. By joining the OYO network, these owners gain access to centralized branding, digital distribution, and operational playbooks that can elevate both occupancy and service standards.

For many family-run hotels and guesthouses in India, Southeast Asia, and parts of Europe, OYO's systems have provided the first exposure to structured revenue management, standardized housekeeping protocols, and digital reputation management. This has direct implications for local employment, supplier relationships, and community development, as more consistent occupancy can stabilize cash flows, encourage reinvestment, and support year-round work for staff. The broader socio-economic benefits of such tourism-linked development are frequently analyzed by institutions like the World Bank and the International Labour Organization.

For travelers, the tangible outcome is a more reliable experience in markets where budget accommodation was once synonymous with uncertainty. Cleanliness, basic safety standards, and transparent pricing have become more predictable, which is particularly important for families, solo travelers, and small business owners booking frequent stays in regional hubs. Those planning multi-generational trips or extended family reunions can find additional guidance in World We Travel's dedicated family travel coverage.

Responding to Shifts in Traveler Behavior

The 2020s have seen profound shifts in how people travel. Remote and hybrid work have blurred the lines between business and leisure, wellness has moved from a niche to a mainstream priority, and sustainability has become a central consideration for many travelers, especially in Europe, North America, and parts of Asia-Pacific such as Australia, New Zealand, and Japan.

OYO's platform has adapted to many of these changes. The company has expanded into vacation rentals and longer-stay formats that appeal to digital nomads, project-based professionals, and families seeking apartment-style accommodations with kitchen facilities. In cities such as Bangalore, Berlin, and Bangkok, OYO-branded properties now host guests who may stay several weeks, combining client visits or remote work with local exploration. Readers interested in structuring such trips can explore World We Travel's travel tips and business travel sections, which increasingly address the realities of blended travel.

From a health and safety perspective, the pandemic permanently raised expectations around cleanliness protocols, contactless check-in, and transparent information about local health regulations. OYO has integrated these expectations into its standard operating guidelines, leveraging digital check-in, app-based communication, and centralized training to ensure consistent implementation across its network. Broader health and travel guidance from organizations like the World Health Organization and the U.S. Centers for Disease Control and Prevention remains a reference for both platforms and travelers navigating evolving public health landscapes.

Sustainability, Community, and Responsible Growth

As sustainability has moved from a peripheral concern to a core strategic priority across the global travel industry, OYO has had to address questions about its environmental footprint and its role in local communities. The company has introduced energy-efficiency initiatives, encouraged partner properties to adopt smart lighting and HVAC systems, and promoted waste reduction and responsible water usage. While these efforts vary by region and property type, the direction of travel is clear: guests, regulators, and investors increasingly expect measurable progress on environmental, social, and governance (ESG) metrics.

Travelers exploring eco-conscious options can benefit from cross-referencing OYO's initiatives with independent frameworks and best practices from organizations such as the Global Sustainable Tourism Council and the UN Environment Programme. For World We Travel readers, this aligns with the growing interest in eco travel, where accommodation choices are evaluated not only on price and comfort but also on their impact on local ecosystems and communities.

Beyond environmental considerations, OYO's role in supporting local businesses-through sourcing, partnerships, and community engagement-has become increasingly visible. In many destinations across South Asia, Africa, and Latin America, OYO-affiliated properties serve as gateways to neighborhood restaurants, guides, and experience providers, integrating travelers into local economic networks. This community-centric model resonates with travelers seeking authentic cultural experiences, a theme that World We Travel explores extensively in its culture and retreat coverage.

Challenges, Course Corrections, and Governance

OYO's rapid expansion has not been without challenges. The company has faced scrutiny over issues such as contractual disputes with property owners, variability in service quality, and questions about the sustainability of aggressive growth strategies in highly competitive markets. In some regions, regulatory shifts, changing market conditions, and the aftershocks of the pandemic forced OYO to recalibrate its portfolio, exit certain markets, and refine its owner-partner models.

From a governance perspective, the company has had to demonstrate stronger controls, clearer communication with partners, and more transparent performance metrics. This reflects a broader trend in global hospitality and technology sectors, where platforms are expected to balance growth with responsibility, aligning their operations with evolving norms around data privacy, labor practices, and fair competition. Travelers and business stakeholders tracking such issues can find broader context in analyses from institutions like the International Monetary Fund and the World Bank's Doing Business work on regulatory environments.

For guests, these internal recalibrations are most visible in the form of more consistent standards, clearer policies around refunds and cancellations, and a stronger emphasis on verified reviews and transparent property information. For property owners, they manifest in updated contracts, more structured onboarding, and enhanced support channels. The net effect is a platform that has matured from a high-growth disruptor into a more stable, governance-conscious player in the global hospitality ecosystem.

OYO and the Wider Economic Context of Travel

In 2026, travel demand is closely linked to macroeconomic conditions, including inflation, interest rates, and employment trends across key markets such as the United States, the Eurozone, the United Kingdom, Canada, Australia, and major Asian economies like China, Japan, and South Korea. Budget and mid-scale accommodation segments tend to be especially sensitive to shifts in disposable income and corporate travel budgets, making OYO's performance a useful barometer of broader travel affordability.

Data from organizations such as the World Tourism Organization and the OECD indicate that while global tourism volumes have surpassed pre-pandemic levels in many regions, travelers remain value-conscious, often trading down from premium options or shortening stays while still prioritizing travel as a core lifestyle and business activity. In this environment, OYO's focus on affordability and standardized quality positions it well to capture both domestic and regional demand, particularly in large markets like India, Indonesia, Brazil, and parts of Africa where domestic tourism is expanding rapidly.

For World We Travel readers following the intersection of global travel and economic trends, OYO's trajectory underscores how technology-enabled platforms can both respond to and shape demand, making travel more accessible while also raising expectations for transparency and service quality at all price points.

What This Means for World We Travel Readers

For travelers using World We Travel as a planning companion-whether they are organizing a family road trip across the United States, a culture-focused journey through Italy and France, a business circuit in Germany and the Netherlands, or a wellness retreat in Thailand or South Africa-OYO represents one of several viable options in the accommodation mix. Its properties are particularly relevant when reliability, price, and ease of booking take precedence over brand prestige or extensive on-property amenities.

In practice, this means that a traveler might choose an OYO-branded hotel for a one-night airport stay in Singapore, a budget-friendly base in a secondary city in Spain, or a longer stay in an apartment-style unit in India while working remotely. By combining OYO stays with other accommodation types-boutique hotels, eco-lodges, or branded chains-travelers can build itineraries that balance cost, comfort, and experience. Those exploring such combinations will find practical guidance across World We Travel's coverage of travel, hotels, and health-focused travel, which together reflect the diverse priorities of modern global travelers.

Looking Ahead: OYO's Role in the Next Chapter of Hospitality

As the hospitality industry continues to evolve through 2026 and beyond, OYO's future will hinge on its ability to deepen trust with both guests and property owners while maintaining the agility that allowed it to scale so rapidly. This involves continued investment in technology, more granular attention to service consistency, and a sustained commitment to sustainability and community impact. It also requires navigating regulatory shifts, competitive pressures, and changing traveler expectations in markets as diverse as the United States, the United Kingdom, Germany, Japan, Brazil, and South Africa.

For the global audience of World We Travel, OYO's story is more than a corporate narrative; it is a lens through which to understand how budget and mid-scale hospitality are being reshaped by data, platforms, and new patterns of work and leisure. As travelers plan their next journeys-whether for business, family, culture, or retreat-they will increasingly interact with ecosystems built by companies like OYO, where technology underpins not only how rooms are booked, but how value, safety, and trust are delivered.

In this environment, informed choice becomes the traveler's most important asset. By combining independent research from authoritative sources, insights from platforms like World We Travel, and transparent information from providers such as OYO Hotels & Homes, travelers can design itineraries that align with their budgets, values, and aspirations, while contributing to a more connected, sustainable, and inclusive global travel landscape.