How Blockchain Is Reshaping Global Travel in 2026

As the travel industry enters 2026, it finds itself at the intersection of unprecedented digital transformation, shifting traveler expectations, and growing pressure to operate more securely, sustainably, and efficiently. From corporate travel managers in the United States and Germany, to leisure travelers in Australia, Singapore, and Brazil, stakeholders across the world are demanding smoother journeys, transparent pricing, and stronger protection of personal data. Against this backdrop, blockchain technology has moved from experimental pilots to serious strategic consideration, particularly for organizations seeking to modernize complex, high-volume travel transactions.

For the team at World We Travel, which focuses on connecting travelers and businesses with global insights across destinations, business travel, hotels, and the wider global economy, blockchain is no longer a distant concept. It is increasingly a practical tool that can underpin new forms of trust, collaboration, and value creation across airlines, accommodation providers, travel management companies, and technology partners worldwide.

Blockchain Fundamentals in a 2026 Travel Context

Blockchain is often still associated in the public imagination with early cryptocurrencies such as Bitcoin, but for travel leaders in Europe, Asia, North America, and beyond, it is better understood as a distributed, cryptographically secured ledger that allows multiple parties to record and verify transactions without relying on a single central authority. Each transaction is grouped into blocks, linked together in chronological order, and validated through consensus mechanisms, making the record effectively immutable and resistant to tampering.

In the travel sector, this means that bookings, payments, loyalty redemptions, identity verifications, and even baggage handovers can, in principle, be recorded on a shared ledger that every authorized party can trust. When combined with smart contracts, which are self-executing agreements encoded directly on the blockchain, complex workflows that once required extensive manual reconciliation can be automated and audited in real time. Organizations such as IBM and Microsoft have continued to invest in enterprise-grade blockchain platforms, and travel executives regularly follow developments through resources like IBM's blockchain hub and the World Economic Forum's work on blockchain and digital trust.

By 2026, this underlying capability has become particularly relevant to global travel because the industry operates across multiple jurisdictions, currencies, and regulatory regimes, while handling sensitive customer data and processing millions of transactions per day. A technology designed from the ground up to provide shared, tamper-resistant records is naturally aligned with these challenges.

The Persistent Pain Points in Modern Travel Transactions

Despite strong digital adoption, the travel ecosystem remains fragmented. Airlines, global distribution systems, online travel agencies, hotel chains, rail operators, and car rental companies often operate on legacy platforms that were never designed to interoperate seamlessly. This fragmentation is especially visible to multinational corporations managing complex travel programs across the United Kingdom, Canada, Japan, and South Africa, where inconsistent data and slow reconciliation can increase both cost and risk.

From a traveler's perspective, the booking journey can involve multiple intermediaries, each adding fees, latency, and potential points of failure. Payment flows are complicated by cross-border card processing, foreign exchange spreads, and chargeback risks, particularly for long-haul routes between regions such as Europe and Asia or North America and South America. Industry reports from organizations like the World Travel & Tourism Council and the International Air Transport Association have repeatedly highlighted inefficiencies in settlement, distribution, and back-office reconciliation.

Security and privacy remain equally critical. High-profile breaches in both hospitality and aviation have demonstrated how vulnerable centralized databases can be when they store large volumes of personal and payment data. Regulators from Brussels to Singapore and Seoul have responded with tougher data protection and cybersecurity rules, reflected in frameworks such as the EU's GDPR and guidance from the Monetary Authority of Singapore on digital payments and data governance. For travel brands, maintaining trust now depends on demonstrating robust protection of traveler identities and transaction records.

Loyalty programs, a core asset for airlines and hotel groups in markets such as the United States, United Kingdom, France, and Thailand, face their own structural issues. Points are often siloed, difficult to redeem across brands, and governed by opaque rules that can change with little notice. This undermines customer confidence and complicates accounting and liability management for program operators.

These challenges, taken together, create a strategic opening for blockchain to serve as a shared transactional backbone that can reduce friction, strengthen security, and improve transparency across the entire journey, from trip planning on sites like World We Travel's travel hub through to final expense reconciliation at work.

How Blockchain Enhances Security, Trust, and Efficiency

The most immediate value proposition of blockchain for travel transactions lies in its security model. Instead of storing sensitive booking and payment data in a single database vulnerable to insider threats or external attacks, blockchain distributes records across multiple nodes and protects them with advanced cryptography. Any attempt to alter historical data would require compromising a majority of the network, which is prohibitively difficult in well-designed systems. Cybersecurity specialists, including those referenced by the National Institute of Standards and Technology, increasingly view distributed ledgers as a meaningful component of a defense-in-depth strategy.

For travel organizations, this architecture can significantly reduce the risk of large-scale data breaches while enabling more granular control over who can see what. Emerging decentralized identity frameworks, championed by groups such as the Decentralized Identity Foundation and reflected in standards work at the World Wide Web Consortium, allow travelers to hold verifiable credentials (for example, passport details or frequent flyer status) in digital wallets and selectively share only the minimum information needed at each touchpoint. This approach has the potential to streamline airport security, hotel check-in, and cross-border verification, particularly in heavily traveled corridors such as US-EU, UK-Asia, and intra-Schengen routes.

Transparency is another key advantage. When bookings, modifications, and cancellations are written to a shared ledger, all authorized stakeholders see the same version of the truth. Disputes over no-shows, overbookings, or payment settlements can be resolved by consulting the immutable record, rather than relying on fragmented logs and email trails. Corporate travel managers in Netherlands, Sweden, and Denmark, who must reconcile high volumes of transactions for distributed workforces, can benefit from faster, more accurate reporting and reduced administrative overhead.

Smart contracts further enhance efficiency by automating business rules that today require manual intervention. A smart contract can, for example, automatically release payment to a hotel once a stay is confirmed as completed, or trigger an automatic partial refund when a flight delay exceeds a contractual threshold. Insurtech innovators in markets such as Switzerland and Japan are already experimenting with parametric travel insurance products that use real-time flight status data and blockchain-based contracts to settle claims instantly, as highlighted in industry analyses from McKinsey & Company and Deloitte.

For loyalty programs, blockchain enables points to be tokenized and made interoperable across multiple brands and even across sectors, such as travel, retail, and entertainment. This can increase perceived value for travelers in Italy, Spain, Malaysia, and New Zealand, who frequently move between airlines and hotels, while giving program operators better visibility over issuance and redemption patterns.

Practical Applications Across the Travel Journey

In 2026, the most compelling blockchain use cases in travel can be grouped around identity, distribution, payments, and operational transparency, each with implications for both leisure and business travelers.

In identity verification, governments and industry groups are gradually exploring digital travel credentials that could be anchored on blockchain. While initiatives such as IATA's digital travel pass have evolved over time, the broader push toward verifiable, privacy-preserving credentials remains strong, particularly in regions like Singapore, South Korea, and the Nordic countries, which have robust digital identity ecosystems. Travelers could consent to share cryptographically signed proofs of identity, vaccination status, or visa eligibility, with airlines, border authorities, and hotels, without exposing full underlying documents. Resources from the International Organization for Migration and UN World Tourism Organization frequently highlight how secure digital identity can facilitate more seamless and responsible cross-border mobility.

On the distribution side, decentralized marketplaces such as Winding Tree have demonstrated how blockchain can connect suppliers directly with agents and travelers, reducing dependence on traditional intermediaries and lowering distribution costs. While these platforms are still in various stages of maturity, they illustrate a possible future where inventory from airlines, independent hotels, and alternative accommodations can be discovered and booked through open, interoperable protocols. For travelers exploring new destinations or planning multi-country itineraries across Asia, Africa, and South America, such ecosystems could offer more competitive pricing and greater transparency on fees.

Payments and settlement are another area of active experimentation. Some online agencies and airlines now accept cryptocurrency or tokenized fiat payments for flights and hotels, which can be especially attractive for international travelers seeking to avoid high foreign exchange and card fees. According to industry commentary from the Bank for International Settlements, cross-border payment innovation, including blockchain-based solutions and central bank digital currency pilots, is accelerating, and the travel sector stands to benefit substantially from faster, cheaper settlement mechanisms. That said, volatility and regulatory scrutiny mean that most mainstream travel brands focus on stablecoins or blockchain rails for fiat currencies, rather than speculative crypto assets.

Operationally, blockchain can support end-to-end visibility over assets and services. For example, each handover event in the baggage journey-from check-in to loading, transfer, and arrival-can be recorded on a shared ledger accessible to airlines, airports, and ground handlers. This can reduce lost luggage incidents and provide travelers with more precise tracking information. Similar principles apply to catering, maintenance, and hotel supply chains, where transparent provenance and real-time status can improve service reliability and support sustainability reporting. Organizations such as the International Civil Aviation Organization and the International Hotel & Restaurant Association have noted the potential for digital traceability to enhance both safety and customer experience.

Case Studies and Industry Initiatives

Several early-mover initiatives have helped shape how travel leaders think about blockchain's role in real-world operations.

Winding Tree has continued to develop a decentralized travel infrastructure that allows airlines, hotels, and travel agencies to connect directly without relying entirely on legacy distribution systems. By leveraging open-source protocols, the project aims to reduce transaction costs and foster innovation among smaller suppliers who may struggle to access traditional channels.

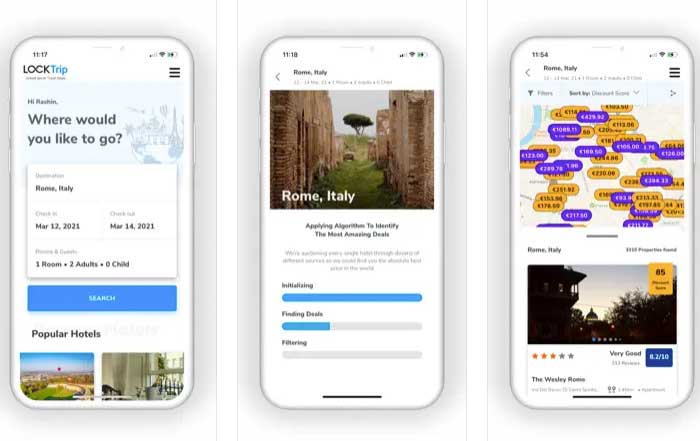

In the accommodation space, LockTrip has experimented with a blockchain-based marketplace that minimizes commissions and uses its own blockchain, Hydra, to process reservations. Similar models have inspired discussions among hotel owners and asset managers in markets such as France, Italy, and Thailand, where distribution costs and rate parity constraints have long been contentious topics.

Major incumbents have also entered the field. Travelport's collaboration with IBM on blockchain pilots for travel distribution and settlement has provided a blueprint for how large global platforms might integrate distributed ledger technology into existing workflows. Likewise, agencies like Alternative Airlines have introduced cryptocurrency payment options, demonstrating that there is real demand among certain traveler segments for more flexible and borderless payment methods.

Parallel to these commercial initiatives, industry associations and consortia have begun to explore common standards and governance frameworks. The World Economic Forum, for instance, has convened public-private dialogues on blockchain in supply chains and mobility, while the OECD has examined blockchain policy implications across sectors, including tourism. These efforts underscore that blockchain's value in travel will ultimately depend on interoperability, shared rules, and broad-based adoption, rather than isolated pilots.

Regulatory, Technical, and Organizational Hurdles

Despite promising progress, travel executives considering blockchain must navigate a complex landscape of regulatory, technical, and organizational considerations.

From a regulatory standpoint, the cross-border nature of both travel and blockchain raises questions about jurisdiction, data residency, and compliance obligations. Financial regulators in the United States, United Kingdom, European Union, and Asia-Pacific have introduced detailed rules on digital assets, anti-money laundering, and consumer protection, which any blockchain-enabled payment or tokenized loyalty scheme must respect. Legal guidance from organizations such as the Financial Action Task Force and national authorities like the UK Financial Conduct Authority is therefore essential for travel companies designing compliant solutions.

Technically, integrating blockchain with existing reservation, revenue management, and property management systems can be challenging. Many airlines, rail operators, and hotel groups still rely on decades-old mainframe architectures that were never intended to interface with distributed ledgers. Successful projects typically follow a phased approach, starting with specific use cases-such as loyalty point reconciliation or interline settlement-before expanding to more complex workflows.

Scalability and performance also remain under scrutiny. While newer blockchain protocols and so-called layer-two solutions have significantly improved transaction throughput compared with early networks, global travel volumes, particularly in peak seasons across Europe, North America, and Asia, are immense. Careful design choices are required to balance decentralization, speed, and cost, and many enterprise deployments use permissioned or hybrid models to achieve the necessary performance.

Organizationally, blockchain adoption requires collaboration among competitors, partners, and regulators who may have differing incentives and risk appetites. The full benefits of shared ledgers only emerge when multiple parties agree to participate and align on data standards. This can be particularly complex in fragmented markets such as Africa and South America, where infrastructure maturity and regulatory consistency vary widely.

Finally, user experience must not be overlooked. Travelers booking family vacations through World We Travel's family travel insights or planning wellness escapes via our retreat and health sections are unlikely to care whether their transactions run on blockchain; they care about speed, clarity, and reliability. Any blockchain-based solution must therefore be abstracted behind intuitive interfaces and robust customer support, ensuring that the technology enhances, rather than complicates, the journey.

Strategic Outlook: Where Blockchain and Travel Converge Next

Looking ahead to the late 2020s, blockchain's role in travel is likely to deepen in tandem with other technological trends that World We Travel tracks closely through its technology and work coverage.

The evolution of smart contracts is expected to enable more sophisticated, event-driven travel products. For example, dynamically priced corporate travel agreements could automatically adjust rates based on volume thresholds or sustainability performance, while integrated travel-insurance contracts could instantly compensate travelers for missed connections or severe delays using verifiable data feeds.

Integration with the Internet of Things will also be important. As more hotel rooms, rental vehicles, and airport facilities become sensor-enabled, blockchain can provide a secure backbone for recording usage data, managing access rights, and coordinating maintenance. A traveler in Finland or Norway might, for instance, unlock a hotel room or coworking space using a digital credential stored in a wallet, with each access event logged on a decentralized ledger shared between property managers and service partners.

Sustainability is another area where blockchain can support both regulatory compliance and traveler expectations, particularly in environmentally conscious markets such as Netherlands, Sweden, and New Zealand. Airlines and hotels can use blockchain to track emissions, energy consumption, and offset purchases in a transparent, auditable way, helping to substantiate claims made under voluntary initiatives and emerging regulations. Organizations like the UN Environment Programme and the Science Based Targets initiative have emphasized the importance of reliable data and verification in climate reporting, and blockchain can contribute to this credibility. Travelers exploring our eco-travel insights increasingly look for such verifiable sustainability signals when choosing providers.

At a governance level, decentralized autonomous organizations (DAOs) may play a role in managing shared travel infrastructure or community-owned tourism assets. While still nascent and subject to legal uncertainties, DAOs offer a framework for collective decision-making and revenue sharing that could be relevant for regional tourism boards, destination marketing organizations, or cooperative hotel and tour networks in locations ranging from South Africa to Brazil and Thailand.

What This Means for Travelers and Businesses Using World We Travel

For the global audience that turns to World We Travel for guidance on travel tips, business travel strategy, and broader global trends, blockchain's rise in the travel ecosystem carries several practical implications.

Leisure travelers can expect to see more seamless, personalized, and secure experiences as digital identities, tokenized loyalty, and real-time settlement become more common behind the scenes. Families booking multi-stop itineraries, remote professionals working from different continents, and wellness seekers heading to retreats in Asia or Europe may benefit from clearer pricing, faster refunds, and better control over how their data is used.

Corporate travel buyers and managers will increasingly evaluate suppliers not only on price and service quality, but also on the sophistication of their data infrastructure and their ability to integrate with blockchain-enabled workflows for settlement, reporting, and compliance. This may influence preferred supplier lists, RFP criteria, and long-term partnerships, particularly for multinational organizations operating across United States, United Kingdom, Germany, China, and Singapore.

For travel providers-airlines, hotel groups, online agencies, mobility platforms-the strategic question is how to participate in this transition in a way that strengthens competitiveness and trust. That may involve joining industry consortia, partnering with technology firms, or selectively deploying blockchain for high-impact use cases such as loyalty, settlement, and digital identity, while continuing to modernize broader IT architectures.

As World We Travel continues to cover developments across destinations, technology, sustainability, and the evolving travel economy, blockchain will remain an important lens through which to understand how value, trust, and experience are being redefined. The technology is not a cure-all, and many challenges remain, but in 2026 it is clear that blockchain has moved from theoretical promise to practical tool-one that, when thoughtfully implemented, can help create a more transparent, efficient, and traveler-centric global travel ecosystem.

For travelers and businesses alike, staying informed and engaged with these changes will be essential to making smarter decisions, capturing new opportunities, and ensuring that the next generation of travel is not only more digital, but also more secure, sustainable, and trustworthy.